7 min read

Get Out Of MCA: Escape The Grip of Merchant Cash Advances

![]() Rob Misheloff

Mar 30, 2016 9:00:03 AM

Rob Misheloff

Mar 30, 2016 9:00:03 AM

Have you taken a merchant cash advance?

(or 4?)

We occasionally help customers access this type of business financing, but we’re much more likely to talk you out of a merchant cash advance than to sell you on the idea.

The thing is…

… when you learn the truth about these products…

… it’s pretty obvious…

…rates are way high...

Don't take my word for it though. According to a report from the Opportunity Fund, the average annual percentage rate (APR) for an MCA can range from 60% to 200% or more, making them an expensive financing option.

…but those nice people that help your business access capital told you the 100% truth when you signed, right?

Right?

Special Note: If you’re stuck in merchant cash advances that you can’t pay, you might want to talk to a negotiator to help make your payments lower. We partner with a great company that can help you get out of a daily payment product.

Do Business Cash Advance Lenders Lie to You?

Not to make gross generalizations or anything…

…but is the Pope Catholic?

First, we’re not going to badmouth any specific companies here.

Trash-talking on specific companies takes away from the focus of helping you avoid scams.

But hating on sleazy practices?

We’ll do that all day.

So… imagine you were to put your information into a “lead generation site.”

You know… the ones where you get calls and emails from 4 different companies?

Would those companies tell you the truth?

well... the Federal Trade Commission (FTC) has been taking action against MCA providers for deceptive marketing practices.

One example - in 2018 , the FTC charged two MCA companies with misleading small business owners about the costs of their financing products.

To find out…

What if you put a fake name and email into one of those portals?

Let’s tell the computer that:

- You need $150,000

- You’ve been in business for 3 years

- You do $800,000 in revenues

- Credit is “ok” – around a 640-679

The site vomits out 4 lenders that want to “compete” for my business.

Let’s check out the first one in the list…

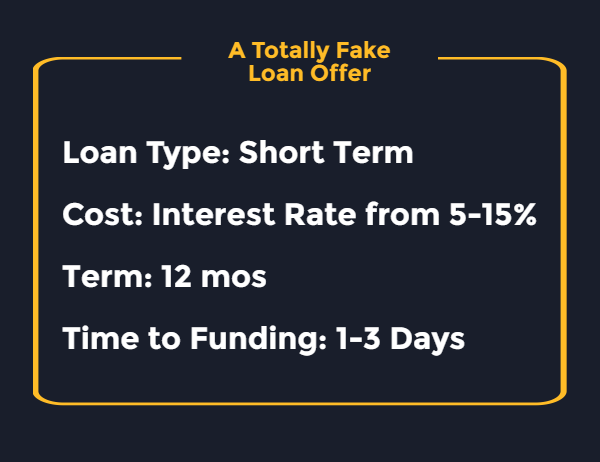

Here is exactly (word for word) the first offer:

Sounds pretty good, doesn’t it?

I mean… if those guys were lying to me about the interest rate… I couldn’t possibly know… it would just be a guess.

Right?

Actually, the first company in the list to offer a loan is publicly traded.

When you offer company stock to the public, you have to file documents with the Securities Exchange Commission (SEC).

While you can get away with spouting utter BS on the Internet… it’s not a very good idea to lie in publicly filed documents.

If I look at the company’s most recent annual report, in the 4th quarter of 2015, the average loan they offered carried an interest rate of over 40%.

But up above it said 5-15%.

Unfortunately... this is pretty common.

A report by the Responsible Business Lending Coalition highlights the potential for predatory lending practices in the MCA industry and emphasizes the need for transparent pricing, fair collection practices, and responsible underwriting.

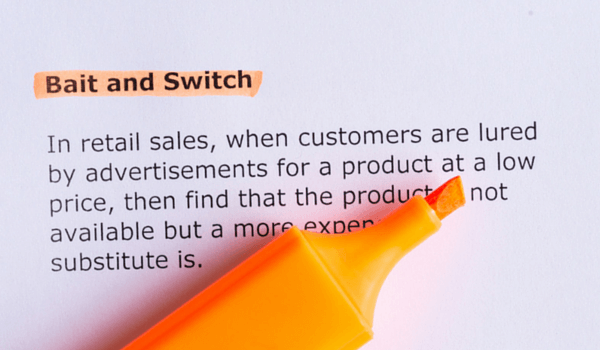

Kind of sounds like a bait-and-switch, doesn’t it?

So… if a big company that has to file documents with the government is a little loose with the truth…

It’s not a stretch to imagine that the little guys aren’t always playing straight with you either.

Do Cash Advance Interest Rates Matter?

So… if a company advancing you funds tells you the 100% truth about the costs involved in the product…

…and you agree to the terms…

That’s totally cool.

It doesn’t matter if the interest rate is 5%... or a billion trillion percent.

In fact, there’s no such thing as a bad loan… only bad fits.

But when a company that has never done a single loan at 5% tells you that rates are 5-15%...

That blows.

The real problem with these products isn’t the rates, though.

It’s the size of the payments.

What’s Wrong with Merchant Advance Payments?

If you’re talking to a merchant advance loan salesperson, you’ll notice they always talk in terms of daily payments.

You see… business owners think in terms of monthly revenues and expenses.

Imagine you get a $25,000 business cash advance for 6 months.

Quoting your payment as “just $250 a day” makes it sound like a lot less than $5,200 a month.

Because making $5,000+ payments on a $25,000 advance kinda sounds like it sucks, doesn’t it?

Or… since that $5,000+ payment is bleeding you dry…

(The Federal Reserve Bank of Cleveland found that businesses that relied on alternative financing, including MCAs, were more likely to experience cash flow challenges due to the high costs and aggressive repayment terms associated with these products.)

…you may need to get a second advance just to make payments on the first.

(Bloomberg says loan stacking is a growing issue in the online lending industry, and MCA providers have been criticized for contributing to the problem. Here's their report, which says stacking multiple advances can lead to over-indebtedness for small businesses...)

Unfortunately, that’s exactly what a lot of business owners find out after getting stuck with a business advance product.

It’s like being one of those dudes waiting for the liquor store to open at 6:30 AM so they can score a $3 bottle of Popov on the way to work.

Just like guzzling hooch, you know the advance is rotting your business from the inside out, but you’ll die without more money.

(…and being stuck in a merchant cash advance might make you ready for shots by 6:30 AM…)

Often, since the huge payments are sucking away every dime of profit, business owners fail to grow out of the loans.

We even have a name for it in the lending space.

It’s called being stacked.

What is Business Loan Stacking?

Business loan stacking means you’ve already got 2 or more advances against your business.

Since each advance usually sucks away 10% or more of your monthly revenues, once you get past 2 advances you’re often caught in a death-spiral.

That’s when the real vultures come out.

There are companies out there that specialize in “3rd, 4th and 5th position liens…” meaning they’ll advance you funds (at huge costs) even if you’ve already gotten yourself into debt beyond your ability to pay it down.

If you’re at the point where you need a 3rd, 4th or 5th cash advance, it might be time to do some soul searching.

Maybe you’re just weeks away from a huge event that will wash away your debt problems…

But…

Here’s the deal:

More often than not…

You’ll be better off getting yourself out of a merchant cash advance (or other type of daily payment loan) than adding another one.

In fact, Harvard Business School did a study and found out small business who used products like MCAs experienced slower growth than those that used traditional bank loans or lines of credit.

With that, here are 5 ways to get out:

Replace a Cash Advance with a Low Rate Term Loan

If you have good credit, sometimes a long term monthly payment loan at reasonable interest rates can dramatically reduce your monthly payments.

In some cases, we can help you get into a much more reasonable loan.

These monthly payment deals go from 2-5 years and have financing amounts up to $500,000.

Interest rates can go from 6% to 30% on most of these products.

One negative is you’ll still have to pay the entire amount of your merchant cash advance because virtually none of these products allow you to avoid finance charges with early payment.

The second negative is simply that you might not qualify.

In order to have any chance to qualify for a low rate installment loan you’ll need to have:

- At least a 600 credit score

- Be profitable in at least 1 of the past 2 years

- Be able to supply 2 years of tax returns

- No major negatives (such as large tax liens or a bankruptcy in the last 7 years)

If you qualify, however, these loans can be a great way to go.

Click Here To Look Into a Low Rate Term Business Loan

Get a High Rate Monthly Payment Loan

For higher risk customers (anyone who doesn’t qualify for lower rate financing) all is not lost.

Sometimes, you can qualify for a high rate loan.

I know… that doesn’t sound very good. (But at least it's better than a MCA reverse consolidation...)

However, if you’re struggling with a merchant cash advance, you’re already in a high rate loan.

Sometimes we help customers get into a longer term loan with no prepayment penalties.

It’s not a great loan, but you will actually know the interest rate, and payments can be stretched to ten years.

The loan has no prepayment penalties, so you can pay it off early and save (usually huge) interest charges.

There’s no denying the fact that these high rate loans are lousy. However, they are less lousy than your current situation if you’re saddled with multiple cash advances.

In many cases, we find that even with astronomical rates, refinancing into a 10-year term can drop your monthly payments by 50% or more.

Use Asset-Backed Loans to Pay Off Cash Advances

If you own assets such as real estate, trucks, or heavy machinery, you can often get capital using the assets as collateral.

The negative of course, to collateralized loans is that you can lose your assets if you don’t make the payments.

We talk more about using assets to secure business financing in this article.

Get a Negotiator to Help You Out

Did you know that you can renegotiate your business debt?

This is true whether it’s a merchant cash advance, an ACH loan (the kind that draw out of your bank every day) or any other debt.

If your business is having trouble making the payments, that debt can be negotiated.

You wouldn’t want to try negotiating yourself though.

Your best bet is to hire a debt restructuring company.

You have to be careful though, since some companies will try to charge you large fees before they’ve done anything for you.

We partner with some folks that can renegotiate your debt in some circumstances.

What we like about these guys:

They don’t make any money unless they actually help you.

Click Here to Be Connected to a Debt Negotiator

These folks have saved many a business owner from certain bankruptcy.

Which gets us to the final option…

File for Bankruptcy

If you have no options to get out, and you cannot keep up with daily payments, you can always file bankruptcy.

It would be unethical (maybe illegal) for this blog to try to give you bankruptcy advice.

So… I won’t.

The only words of wisdom to impart is to speak to an attorney or someone else who is qualified to give bankruptcy advice.

Conclusion:

Merchant cash advances are an ugly product.

More often than not, when we talk to folks with multiple advances, the payments are crushing their business.

If you’re stuck in any sort of business cash advance, your best bet is to find any way you can to get out.