Quick…

What’s the difference between…

… a lying scumbag finance company…

…and a bucket of spit?

That’s right…

The bucket.

Funny, right?

Wanna know what’s not so funny?

Lying to you about the rates.

Right?

Check this out…

Special Note: If you're in a hurry, and just want to speak to a live person (who will tell you the truth), you may skip all the reading and click here.

Why do Boom Truck Lease Companies lie about the Rates?

So…

…if you search for info online about bucket truck financing…

You might see the following claims:

- No down payment requirements

- Rates from 5%

- Deferred payment options

- First 2 payments at $99

That sounds awesome, doesn’t it?

Not so awesome…

Bait and switch.

You want super low rates?

You can totally get them.

Of course, you’ll need:

- Good personal credit

- Good business credit

- 5+ years in business

- Good business cash flow

If you don’t have all the above criteria…

… you won’t get those ultra-low rates.

Nobody tells you that on their websites though.

That would be crazy.

But, guess what?

We’re all stocked up on crazy pills.

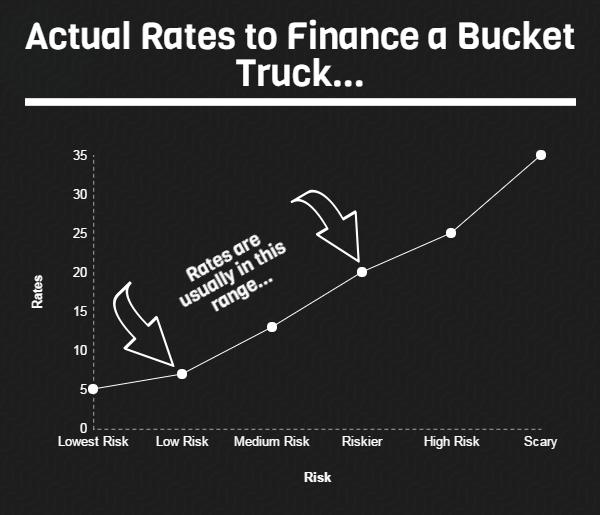

Real Rates to Finance a Bucket Truck

So, yeah.

Companies that brag about 5% leasing rates for tree equipment.

99 times out of 100...

Their customers won’t qualify for that. You can start here to get an honest quote.

Usually, if you’d qualify for (almost) free financing, you just get it from the dealership anyway.

What you’d pay though?

It depends.

Important things that determine your rates:

- Are you a startup or an established business?

- How old is the truck (and how many miles…)

- What is your credit score?

- Do you have plenty of liquid funds? Or are you flat broke?

Here’s what real rates look like:

You’ll notice…

This chart shows you the low rates just like everyone else.

But…

Find out what your rates will be to finance a boom or bucket truck

And… if you’re pretty risky…

With bad credit and limited funds… you’ll end up paying more.

Of course…

Your contract will be expressed in terms of “payments”, not “rates.”

Here’s the deal:

Do you know what the difference is in payments between a 6 percent rate and a 9 percent rate?

Imagine a $20,000 bucket truck financed over 3 years.

You’d pay $608 a month at 6 percent.

Now, with a 9 percent “rate” you’d pay $635.

The difference in payments is $27.

$27.

Do you know how many business owners get robbed shopping until they find a thug willing to pretend their rates will be 6%?

(Sometimes, the rates will be 6% for reals… but usually not).

The truth is…

Someone who is fixing to tool you up can quote any rate they want.

They aren’t constrained with nuisances like the truth.

Now…

…in riskier situations…

your payments on that same truck might go up by $100 (or more… it depends).

Guess what…

$100 a month extra will make no difference to your business.

Getting plopped into a sham contract though…

That’s gonna hurt.

Bucket Truck Lease Calculator

How much will your payments be on a bucket truck lease?

Wanna know a secret?

I have no idea.

This calculator here will give you a best guess... but a web calculator can't account for all the little things that go into finding a payment.

So... use it for an idea... but remember that no calculator is perfect.

What Down Payment Will You Need for Bucket Truck Leasing?

So…

Those same guys that brag on the rates you won’t get?

They usually also brag on no down payments.

Zero down payment is a possibility sometimes.

But if it is for your startup company with no collateral and you have a 550 credit score?

Yeah… not very likely.

In most cases, someone with at least “ok” credit can do a bucket or boom truck lease with 1 or 2 payments upfront.

Of course, what few tell you…

With poor credit, you may be asked for 20% or more as a down payment or security deposit.

(Not always... it depends on how rough your situation is...)

Find out what your down payment will be here.

Other times, you may be asked for collateral…

…and sometimes you can’t get approved at all.

Let’s talk about what’s needed for approval…

Can You Finance a Boom Truck With Bad Credit?

Usually.

It depends.

If you are just starting your business, you’ll usually need:

- At least a 600 FICO -or-

- 50% down payment -or-

- Additional collateral

That doesn’t mean approval is automatic with 600 or higher credit.

A few things can throw a monkey wrench in your plans.

Large tax liens, open judgments, or a recent bankruptcy can all make it much more difficult to be approved.

It’s a little bit easier for established businesses.

In many cases, you can be approved with a low credit score.

It all depends on the situation, but if you have good cash flow, or some collateral, deals can be done.

Financing Older Boom and Bucket Trucks

In today's market...

Not only is new equipment more expensive than before...

But it's hard to actually buy it.

A lot of folks are looking to finance older equipment.

Banks don't like that very much.

We're lucky to offer about 75 different credit programs. We've financed trucks from back when Reagan was president.

Ready to lease or finance your bucket truck?

Give us a call at (866) 631-9996 or click in the picture below to get started.