So, you need to finance a dump truck…

… but your credit isn’t so great…

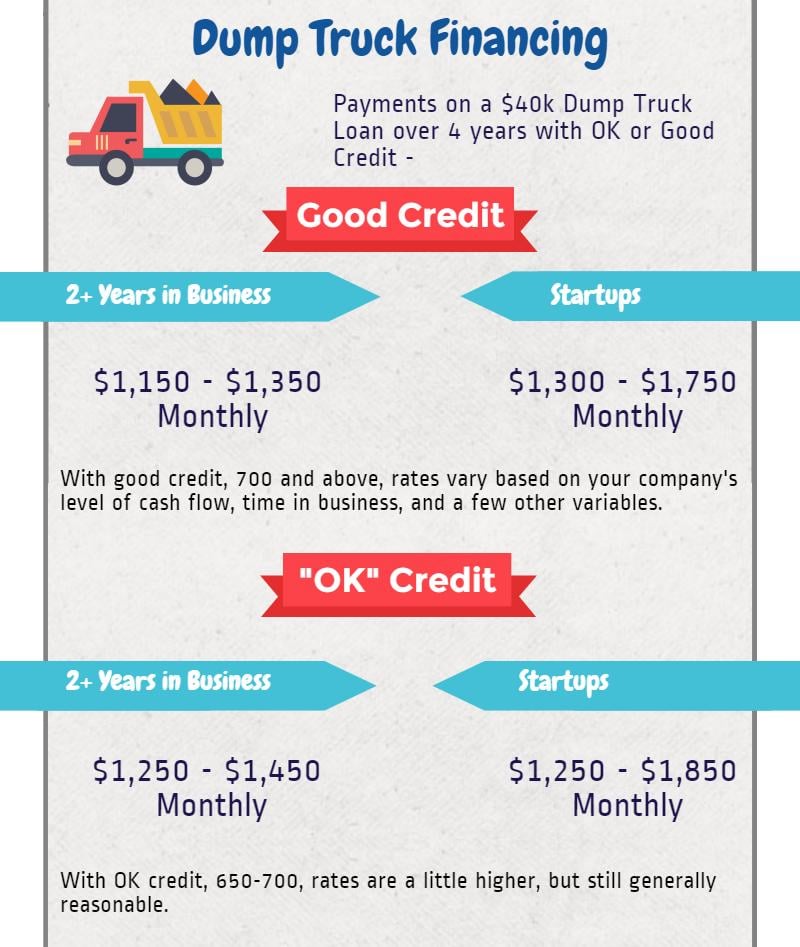

Note: If your credit is not so bad, you may want to check out our Ultimate Guide to Dump Truck Financing

You already know buying your own dump truck is WAY better than driving for somebody else.

(Dump truck owners make an average of $128,263 per year, while those who drive for others make around $17.40 an hour).

Many finance companies won’t consider dump truck loans or leases if you have bad credit.

There are options, though.

Let’s talk about how to buy a dump truck if your credit isn’t perfect.

Free Bonus Section: The first question we get asked about financing a dump truck is usually how much you will need to put down. We've put together a free guide to dump truck down payments. Click here to get access.

Buying a Dump Truck with Bad Credit

Even with bad credit, there are quite a few options to get your dump truck.

The options, of course depend on how bad your credit is, along with a few other factors (covered below)

- What factors to lenders consider for dump truck loans?

- Dump truck financing rates with bad credit

- Low down payment programs for dump trucks

- Getting into a dump truck with a higher down payment

- Offering collateral for your dump truck purchase

- When you won’t qualify for dump truck leasing programs

Click here to get qualified to finance your dump truck

What Factors do Lenders Consider for Dump Truck Loans?

There’s more to qualifying for dump truck financing than just your credit score.

Some lenders will consider:

- Your FICO Score

- The length of your credit history

- How long you’ve been in business

- How much your monthly revenues average

- If you’re profitable

- The age and mileage of the dump truck you’re buying

Then again, some folks barely care about any of that.

(It’s true…)

You’ll usually need to talk to a human to find out which program is best for you.

(Click here if you want advice...)

With that said...

...here are the basics:

Dump Truck Financing Rates With Bad Credit

Did you know there are over 50 different dump truck financing portfolios in the marketplace?

That means dump truck interest rates vary…

…big time.

(It also depends how good or bad your credit is).

Imagine buying a $75,000 dump truck and paying it off over 5 years.

A good credit customer might pay $1,500 a month.

What if you have some dings on your credit or your business isn't established? Your payments might go up into the $1,600 to $2,000 range.

With the worst scenarios, you might see the payments on that same truck at $2,400 or higher.

Want to know a secret?

If your credit is lousy, and so you end up with a lousy approval, usually you should take it. (Whether from us or someone else).

If the payment being a few hundred dollars more than a "prime" customer would get keeps you from making oodles of money with the truck, you shouldn't be buying the truck anyway.

Right?

Find out what your rates would be

Low Down Payment Programs for Dump Trucks

Here’s a call we get often…

“So… I have no business yet… and my credit sucks. I don’t have any down payment… and I don’t want to pay high rates…”

So…

…yeah…

…that’s not going to happen.

Startup businesses with bad credit will pretty much always need a large(ish) down payment.

But…

If your business is established for 2+ years, you can often access dump truck financing for 5% down or less.

Of course, it depends how bad your credit is.

We can help you figure out where you’ll end up with a soft credit pull (that means it won’t hurt your score or show up on your credit report as an inquiry).

Dump Truck Loans With Higher Down Payments

If you don’t qualify for a low-down program, what next?

Higher down payment options are more lenient.

How much higher depends on the program.

There are dump truck loan programs with down payment requirements from 10% to 50%.

On a 50% down program, almost all applicants are approved.

Some of the lower-down programs (10-20%) will require some digging. That means looking at three months of your business bank statements, and sometimes an interview so an investor can understand your plan to make money with the dump truck.

Of course, this assumes you have funds available for that down payment, right?

What if you don’t have the funds available… or need that money for working capital?

Using Collateral to Finance Your Dump Truck

Here’s the deal:

The more you can reduce a lender’s risk…

… the more they’re willing to lend to you.

So… if you can put up some sort of collateral… that makes it much easier to get approved.

Some programs make you post collateral equal in value to what you’re purchasing, while others are less picky.

Collateral usually means one of the following:

- Fully paid-for vehicles

- Fully paid-for business equipment

- Real estate with equity

Notice that while vehicles and equipment need to be fully paid off to use as collateral, the same is not true of real estate.

We’ve seen transactions secured with second- and even third- positions taken on real estate.

You want to be careful putting up your house to secure a financing on a used dump truck.

(That could go bad, right?)

Note when using vehicles or equipment as collateral…

Most lenders consider the “liquidation value” of vehicles or equipment when pricing them out. That means the amount similar assets would sell for at an auction… not from a dealer.

When You Won't Qualify for Dump Truck Financing

Not everyone will qualify to finance a dump truck.

If you’re currently in an open bankruptcy, (not yet discharged or dismissed) – that’s an automatic decline.

Absent an open BK… to qualify there should be at least one good thing.

A good thing could be:

- Large down payment

- A long time in business (5+ years)

- A strong business (healthy revenues and bank balances)

- Collateral

If you don’t have at least one good thing above… AND your credit is bad…

You should work on making a good thing happen.

With one good thing… it’s likely you can get into your dump truck.

Smarter Finance USA can help you finance a dump truck with good or bad credit.

You may contact us, or you may call at (866) 631-9996.