Are you looking to buy a tractor?

You probably know you can save significant money when you finance or lease a used tractor.

In working with many farmers, we find that even though your payments going used might be slightly higher on a "dollar-for-dollar" basis, the payments buying a used tractor will be much lower than when you buy new.

Note: If you don't feel like reading, let's talk. Just click here to apply to finance or lease your tractor, or you may call (866) 631-9996.

If you are buying a new tractor and have excellent credit, a company like Smarter Finance USA may be a lousy choice when you need financing.

Tractor manufacturers have programs that offer rates so low that they don't make any money on the loans or leases - and we simply can't compete with "free."

However, if you're brand new in business, have less than stellar credit, are buying from a private party, or are leasing an older tractor, you will usually not be able to qualify for manufacturer financing, and that's where we can be of service.

What Can I Expect my Tractor Payments to be?

Payments on a used tractor depend on a number of things:

- The price of your tractor

- Your business profile - how long you've been in business, your revenues, and your personal credit

- Whether you're doing a True Lease or a Capital Lease (We'll talk about these options below)

- How long you decide to make payments on the tractor for

So, let's talk about these options

How Pricing Affects Tractor Financing Rates

Much in the same way you are buying a tractor to make money with it, right?

Lenders give you capital to make money for providing loans.

Since lenders make more money by providing big loans than by providing small loans, rates will be slightly higher on cheap tractors than on expensive tractors.

To find out your rates, click here to get started

The differences aren't huge - as an example, a 5-year lease on a $25,000 tractor for someone with excellent credit might run $574 monthly, while that same person could do a 5-year lease on a $75,000 tractor for $1,629 - dividing that $1,629 by three gives a number of $543 - so the financing rates are lower by about $31 monthly per $25,000 of financing provided in this example.

Does Your Credit Affect Rates for Used Tractor Financing?

While the price of your tractor has a relatively small impact on rates of financing, risk factors like your credit, time in business, and revenues have an enormous impact.

This is because lenders have to incorporate the likelihood of whether or not they are going to get paid back - the risk of the loan - into pricing....

(It's ok that not everybody they lend money to pays them back as long as they charge everyone else enough to cover the cost of the businesses that end up defaulting on their tractor payments).

The degree to which your credit has an impact on financing rates is pretty large. In the example above, we talked about someone with great credit (think 700+) leasing a $25,000 tractor for 5 years, and the payment was $574 per month.

Using that same person, but with worse credit, let's look at what monthly payments would be for the same transaction:

In addition to paying double, with credit scores under 620 you can be expected to have to come up with collateral on a 1:1 basis - so to finance a $25,000 tractor with bad credit, you'll need to pledge equipment (machinery or something with license plates on it) worth $25,000 or more.

Why Are Payments to Finance a Tractor Higher for New Businesses?

We talked earlier about the fact that lending companies have to factor in the risk of not getting paid back into how much they charge for a loan or lease.

The most recent statistics show that 36% of all companies fail in the first 2 years.

In your industry, agriculture, only 56% of businesses that start up are still operating 4 years later. If lending companies don't charge newer farmers more than farmers that have been around for 10 years or more, there won't be any lenders left to make loans to you.

For that reason, if you're new in business (under 2 years) and don't have any collateral, you need to have ok credit (typically 625+) and can usually borrow up to $35,000 - though the numbers can be substantislly higher if you've got significant assets already when you're starting.

With very bad credit, you will need to furnish collateral or 50% as a down payment in cash. Again, expect to pay a big premium if you are new in business and have shaky credit - you're looking at that $1,200 number per $25,000 of financing.

If you are new in business, but have good credit, the news is a little bit better. By putting up collateral, you can borrow as much as you need, and can expect to pay around $860 per $25,000 of financing.

Tractor Loans vs. Tractor Leasing: Which is Better?

There are two ways to finance a used tractor purchase: an true lease and a capital lease, or equipment finance contract (EFA).

The main difference between the two:

With a true lease, you make payments for a set period of time (2-5 years) and at the end you may walk away from the tractor, or you'll have the option to purchase the tractor for 10% of the original finance amount -(so if you financed $50,000, you would then own the tractor for a final lump sum payment of $5,000) while with an equipment finance contract you would own the equipment at the end for a final payment of $1.

Lease are typically about 8% cheaper as a monthly payment than an EFA, but the real deciding factor is tax treatment. On a lease, you are eligible to write off the entire payment as an operating expense, which is better on taxes than just depreciating the equipment as you would do with an EFA.

You can always ask us to give you a comparison of both products.

However, on an EFA, you are eligible to write off the first $25,000 of purchase price off immediately, so if your tractor costs $25,000 or less (or not much more than $25,000) it is probably a better move to go with the EFA.

Payments on a Used Tractor: How Long Should You Finance For?

As a general rule, if you have good credit, since your rates will be relatively low, it doesn't cost much more as a total cost of financing to pay off slowly. For lower credit profiles, however, where your interest rates will be much higher, it's probably smarter to pay off the equipment faster.

Let's look at the numbers:

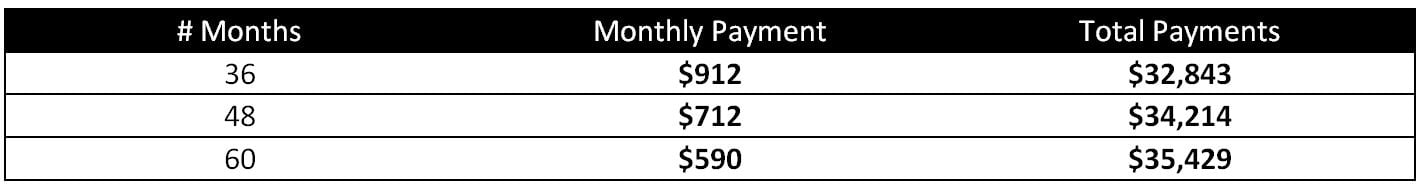

Good Credit Borrower: $25,000 Tractor on EFA ($1 buyout at end)

The difference in total payments between 36 months and 60 months is $2,585, which isn't nothing, but is not really that big a deal. If we look at the difference in payments, however, for a borrower with really bad credit, the story is totally different:

Bad Credit Borrower: $25,000 Tractor on EFA ($1 buyout at end)

While paying off slowly didn't make a big difference for the good credit borrower, the difference for the bad credit borrower between 36 and 60 months as a payment is $19,716 - almost the cost of another tractor.

Notice also that the shorter payoff doesn't inflate the monthly payment by a huge amount.

More articles on Financing for Agriculture

John Deere Tractor Leasing: Costs, Price and other Considerations

How to Lease Farming Equipment with Bad Credit or for a New Business

You might notice through all these figures I keep spewing at you that the financing process for tractors (and anything else) is a little complex, but Smarter Finance USA can help by giving you a quick and easy breakdown relative to your business' unique circumstances. To get a customized quote, click the poicture below or give us a call at (866) 631-9996.