Financing EV Chargers for Business: A Practical Guide

Electric Vehicle (EV) chargers are becoming more common – and it’s happening fast. They serve as the power source for electric vehicles, which are...

5 min read

![]() Rob Misheloff

Apr 22, 2015 5:44:00 PM

Rob Misheloff

Apr 22, 2015 5:44:00 PM

If you're in the fitness industry, you probably can probably spot a scam a mile away when it comes to something about the fitness industry, right?

I'm sure that probably every single day, someone asks you a question like:

"I read on the internet about these specially formulated llama droppings - if I mix them in with my Cheerios, I'll gain muscle and lose 46 pounds by next month..."

Here's the deal:

Just like the hucksters in your industry that are hard to spot if you don't live, eat and breath it every day....

...some companies that offer fitness equipment financing offer similar claims online.

Unless you see what the real results are on a daily basis, it can be hard to separate fact from truth.

Today, I'm going to share with you what it really costs to finance equipment for a gym, how to qualify, and the issues to look out for when it comes to fitness equipment leasing.

Are you ready?

Special Note: If you don't want to read all of this, you can press the "easy" button. Just click here and we'll tell you whether you qualify and what the rates will be.

So... you're probably very familiar with the "before and after pictures" that many people use online to sell fitness products- and how they can be faked.

What you may not have seen in action is the "before and after lease agreement."

Believe me, these sort of documents piss off honest equipment finance professionals just as much as it pisses you off when your customers are told they can drop 30 pounds without dieting or exercising.

Here's how it works:

Sometimes, when you contact a company about leasing fitness equipment, after they run your credit they will send you a document that you think is an actual approval ...

...but is carefully worded so that only an attorney could see that the document is just a "proposal."

Business owners trying to lease fitness equipment get sent bogus proposals like this every single day.

Here's the problem:

A customer recently forwarded me what she thought was an approval from another company- and honestly it took me a few minutes of studying it to catch the swindle that was going on.

You see - at the top of this toilet paper in big letters were the words TERM SHEET and the normal requests for an equipment finance contract that has been formally approved - first and last payment, plus documentation fees.

Get a real proposal with no monkey business

What Usually Happens Next?

Once the company has several thousand of your dollars, they issue you an actual approval, but with much higher costs than was originally on the "term sheet."

Since you already sent in your down payment, if you don't go with their (much higher terms) good luck getting your money back.

Note: Many honest companies will ask for a few hundred dollars in commitment fees just to make sure you aren't wasting their time before they spend a lot of energy putting together your paperwork.

This practice is totally legitimate - and honest companies will fully refund your commitment fee if they can't perform - while it can be hard to tell who is honest or not, some good ways to start would be:

The biggest reason why these things happen?

One of the biggest problems ethical companies run into is that many times, there's a big gap between the payments you'd like to have versus what the payments will actually be.

This isn't a problem at all for crooks, since they'll quote you the payment you want and then find a way to charge you the payments they want.

The truth is this:

1. A lot of gyms fail

2. If you finance your equipment and don't pay, what does a finance company do after repossessing some sweaty yoga mats?

3. Financing is available, but the rates have to incorporate the very real risks of financing a small business.

With that being said, what does it really cost to lease gym equipment?

The costs, quite simply, depend on a lot of factors based on how much risk the lender is taking on. (Get a quote for your own situation here...)

The easiest way to illustrate costs is with some examples:

It's much, much riskier to finance exercise equipment for a new business than for one that has been around for a few years.

How much riskier depends:

If you're buying into a successful franchise, that's a lot less risky than starting a whole new concept, and rates will reflect that.

The other things that will affect your rates:

Let's talk about qualifying for financing as a startup gym owner, and then we'll go over the rates.

If you've got great credit (over a 675 score and a decent history) in most cases, you can qualify for whatever you're looking for.

Of particular interest to startups - most financing companies have a maximum of $35,000 that they can lend to startups. For businesses such as a gym, since you are probably financing dozens of individual items, often we can get creative and spread the transaction amongst several of our syndication partners - and can offer much higher approvals for startups than many of our competitors can.

It depends -

If you have a strong cosigner, often times we can make the deal work. The other way to structure a tough transaction is if you have some collateral such as vehicles or real estate.

Often times, we do get calls from people looking to borrow money to start a business who have poor credit, no assets, and nobody to cosign - and while we'd love to help everybody the truth is, in these cases we're very unlikely to be able to help.

So,

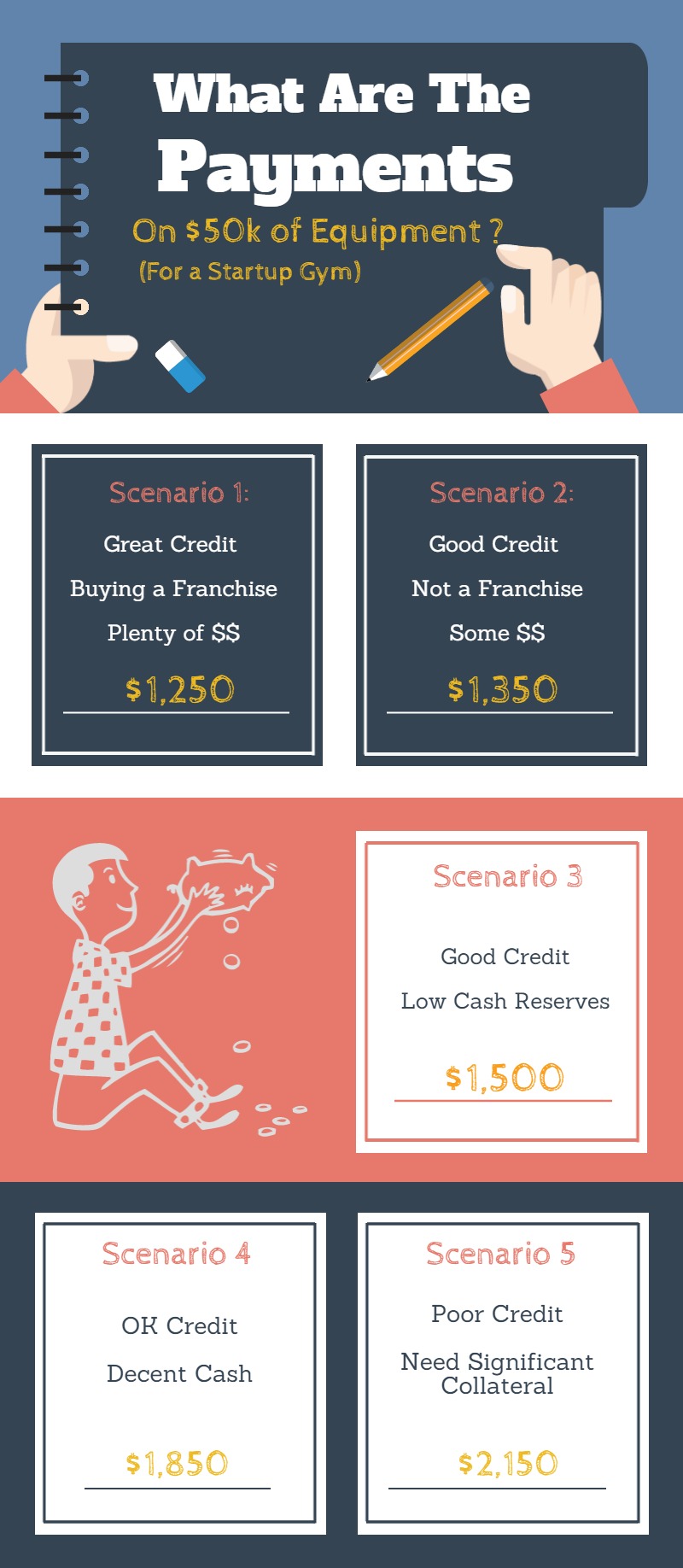

Let's say you want to finance $50,000 worth of treadmills, elliptical machines, or whatever, with a 5-year term.

Let's also say you want to own the equipment at the end (no balloon payment - usually set at a final payment of $1)...

What would your payments be in different scenarios?

Note: While no illustration can be exact, these scenarios are a reasonable approximation of what you could expect to pay. Beware of online resources and "calculators" that only show you the lowest rates....

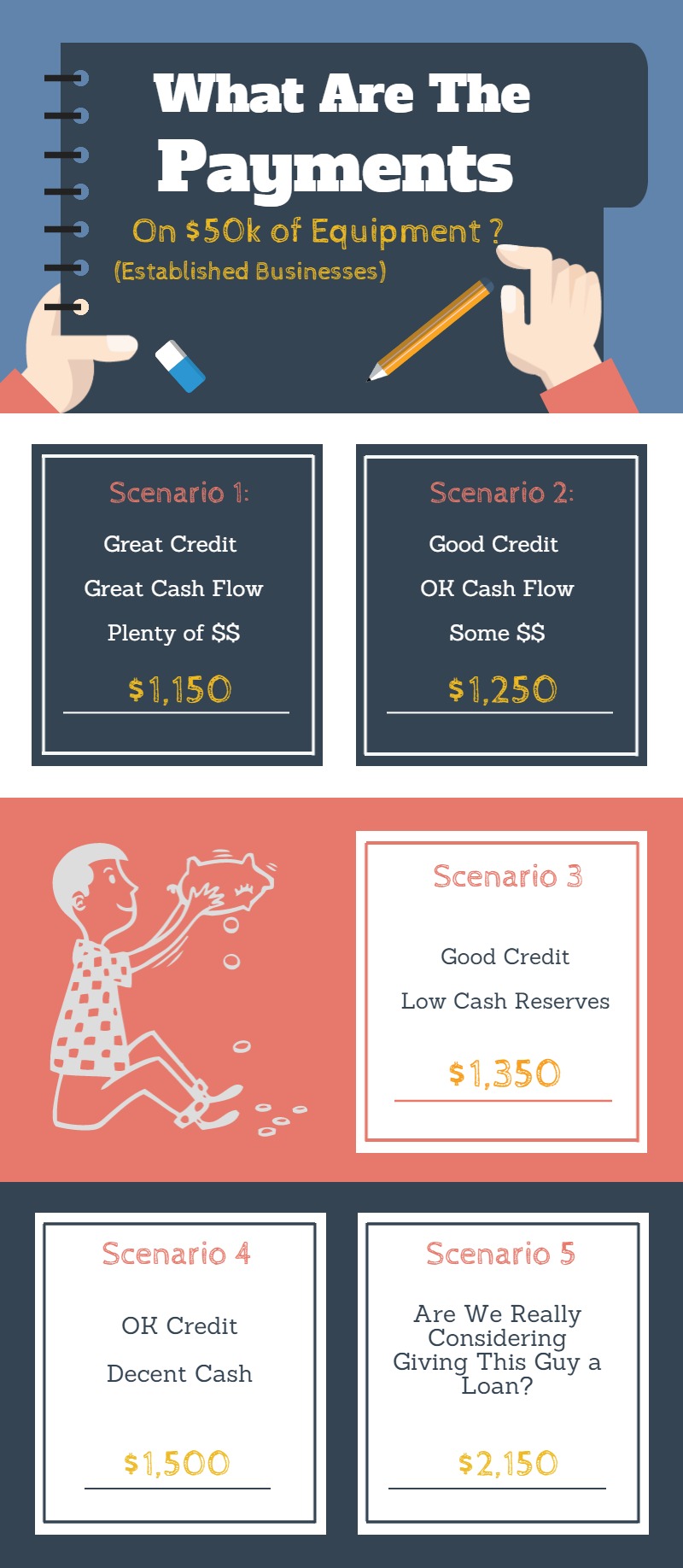

You're adding or updating equipment or adding an additional location, the process of leasing gym equipment is much easier, and cheaper, as you've already shown that you can run a successful gym and that you have the cash flows to cover the payments.

Let's go over the same transaction, $50k in financing over 5 years but assuming you're not a startup.

What would your approximate payments be?

Note that there are some cases where you'll get turned down - such as if you're in bankruptcy or have a serious amount of money in collections, but in most cases, existing business owners can qualify for whatever financing they need.

What should you do next?

If you are looking for an honest quote to learn what your payments would be to finance equipment for a gym, you may call us at (866) 631-9996 or click on the picture below.

Electric Vehicle (EV) chargers are becoming more common – and it’s happening fast. They serve as the power source for electric vehicles, which are...

The economic turmoil caused by the coronavirus pandemic has had an impact on small businesses everywhere. The Economic Injury Disaster Loan (EIDL)...

As a small business owner, you know you need access to capital…